Axis Bank FASTag: How to Apply, Recharge & Check Your FASTag Balance Online

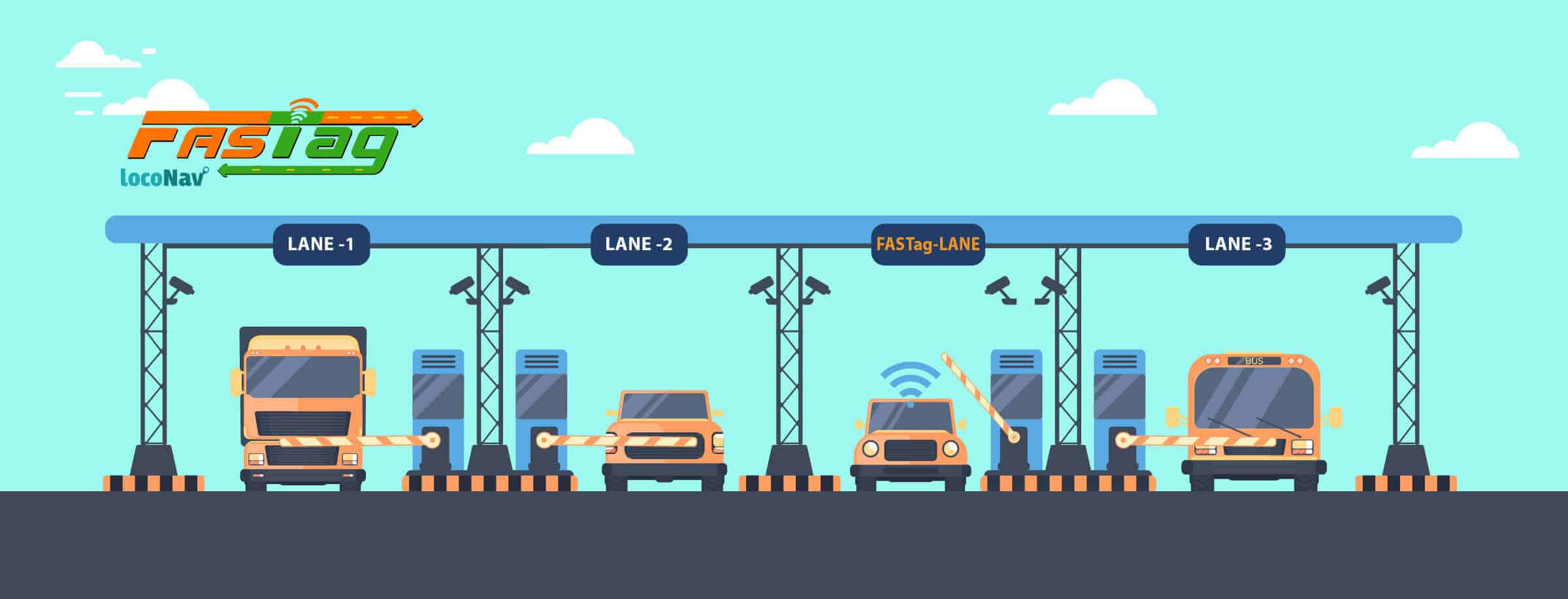

The Ministry of Road Transportation and Highways (MoRTH) has made it compulsory for all vehicles to be appended with FASTag by January 1, 2021. FASTag is a very convenient and easy-to-use tag using which you can pay the toll charges at the toll plazas without waiting in a long queue. The charges are deducted automatically and you need not carry cash every time! Axis Bank is one of the leading providers of FASTags. Learn more about the Axis Bank FASTag, its features and application process.

Features & Value Added Services Offered by Axis Bank FASTag

Make your travel experience seamless with an Axis Bank FASTag! Here are some of the features and value-added service offered by this tag:

- Cashless payment option at all National Toll Plazas

- Charges deducted automatically through a linked account

- Savings on both fuel and time

- SMS alerts sent to the user after every transaction

- Manage your FASTag account online easily

- The doorstep delivery of your FASTag

- Discounts available in case you live within 10km range of toll plaza

- A five year validity period is given on Axis Bank FASTag

- Can be replaced in case it is damaged

- 2.5% cashback given on all toll payments made using Axis Bank FASTag

- Can be used for all kinds of vehicle

- For a non-KYC customer, Rs.10,000 can be added in the FASTag wallet

- For a KYC customer, Rs.1 lakh can be kept as FASTag balance

- Option for Non-KYC customers to increase the limit from Rs 10,000 to Rs.20,000 per month through FASTag Lite Plan

- Various recharge options available online

How to Apply for Axis Bank FASTag?

Getting an Axis Bank FASTag is very easy and a hassle-free process and both the customers, as well as non-customers of Axis Bank can apply for it. Axis Bank FASTag can be obtained either through online mode from the official website of Axis Bank or by visiting the bank branches.

Online Process

If you wish to submit an application for getting an Axis Bank FASTag online, then follow the below-mentioned steps:

Step 1: Open the website, https://www.axisbank.com

Step 2: Click on ‘FASTag’ under the ‘Explore Products’ tab

Step 3: Select ‘Get a Free FASTag Now’ tab

Step 4: Enter your account number if you are Axis Bank customer and proceed further

Step 5: For non-customers, mobile number and vehicle number has to be entered followed by the Captcha code.

Step 6: Enter the OTP sent to the registered mobile number

Step 7: A new page will appear, add the details and required information

Step 8: Opt for a KYC document from the dropdown menu

Step 9: Upload the RC Book of the vehicle

Step 10: Click on ‘Validate’

Step 11: Select ‘Proceed to Payment’ to complete the process

Offline Process

For those who wish to apply for the Axis FASTag offline can do it by visiting the POS location or the Axis Bank branches with all the required documents and KYC paper. It is also mandatory to take your vehicle along with you as the concerned authority will attach the FASTag to your vehicle’s windshield, once everything is validated and the fee is paid. A vehicle registration certificate and KYC documents are very crucial when it comes to applying for an Axis Bank FASTag through offline mode.

Documents Required for Axis Bank FASTag Registration

Since the FASTag account has to be linked with the bank account, the KYC document becomes very crucial. You can submit any of the KYC documents such as PAN Card, Passport or driving licence. Besides this, other important documents required for Axis Bank FASTag registration are:

- FASTag Application form

- Vehicle Registration Certificate

- Passport size photo

Axis Bank FASTag Charges

A one-time fee, threshold amount and security deposit have to be paid in order to purchase an Axis Bank FASTag. The one-time fee is Rs 200 + taxes, the threshold amount is the minimum recharge amount required to activate the FASTag and the security deposit is refundable. The Axis Bank FASTag charges vary according to the class and type of vehicle.

| Vehicle Class No. | Type | Security Deposit (in Rs.) | Minimum Balance (in Rs.) |

|---|---|---|---|

| 1 | Two-wheeler | 100 | 100 |

| 2 | Three – Wheeler Passenger |

350 |

150 |

| 3 | Three-wheeler Freight | 350 | 150 |

| 4 | Car/Jeep/Van | 200 | 100 |

| 5 | Light Commercial vehicle 2-axle | 300 | 140 |

| 6 | Light Commercial vehicle 3-axle | 300 | 140 |

| 7 | Bus 2-axle | 400 | 300 |

| 8 | Bus 3-axle | 400 | 300 |

| 9 | Mini-Bus | 400 | 300 |

| 10 | Truck 2 – axle | 400 | 300 |

| 11 | Truck 3 – axle |

500 |

300 |

| 12 | Truck 4 – axle | 500 | 300 |

| 13 | Truck 5 – axle | 500 | 300 |

| 14 | Truck 6 – axle | 500 | 300 |

| 15 | Truck Multi axle ( 7 and above) | 500 | 300 |

| 16 | Earth Moving Machinery | 500 | 300 |

| 17 | Heavy Construction machinery | 500 | 300 |

| 18 | Tractor | 500 | 300 |

| 19 | Tractor with trailer | 500 | 300 |

Axis Bank FASTag Recharge Process

In order for a FASTag to work, you must maintain a balance in the FASTag. The tag is easily rechargeable and reloadable. There are many payment options available online using which you can recharge your Axis Bank FASTag.

Recharge through Net Banking

Proceed through the following steps if you want to recharge your Axis Bank FASTag using Net Banking:

Step 1: Open the website https://etc.axisbank.co.in/ETC/

Step 2: Log into your FASTag wallet on the portal using the valid user ID and password

Step 3: Click on Retail User and log in

Step 4: Select Road User Center > Payment and Top Up> Recharge

Step 5: Choose Internet Banking option to add money into the wallet

Recharge through NEFT/ RTGS

For recharge using NEFT/RTGS, the below-mentioned steps can be followed:

Step 1: Log into your mobile banking app or internet banking account

Step 2: Add your vehicle as a beneficiary

Step 3: The above step can be done using either your FASTag wallet id number or vehicle number.

Step 4: Enter your bank IFSC code (For Axis Bank it is UTIB0000ETC)

Step 5: Once done, the amount is added to the wallet

Step 6: Since the beneficiary is added, you can easily repeat the recharge

How to Check Axis Bank FASTag Balance?

You can check FASTag Balance using “My FASTag App”. The app can be downloaded on your mobile phone. It works on both iOS and Android smartphones. Once the app is downloaded, enter your login details and then check your Axis Banks FASTag Balance. Axis Bank also has dedicated customer support and you can call on the helpline numbers to know about your FASTag Balance.

Axis Bank FASTag Customer Care Contact Details

In case you wish to know more about the ICICI FASTag, you can call their customer care number, 1800 2100 104 (Toll-Free Number) or 1860 2670 104 (Chargeable Number).

Frequently Asked Questions

You can buy Axis Bank FASTag from POS. These PoS counters are located either at the toll plaza or the Axis Bank branches. You need to take the required documents including the KYC paper and your vehicle to get an Axis FASTag through POS.