Fleet Risk Management is crucial for a smooth-running fleet. It is critical to prevent costly fines, prevent accidents and corresponding legal expenses, and ensure the safety of staff and other drivers.

Compliance with increasing compliance and insurance obligations also drives effective fleet risk management strategies. Running a compliant fleet has hurdles – there is a legal labyrinth to negotiate, and risk assessment must be completed. Still, most importantly, you must understand what is required of you, and what must be done to fulfill those all-important management requirements.

What is Fleet Risk Management?

Fleet risk & safety management is how businesses protect the safety and security of their drivers, other fleet staff, and vehicles. It also entails the creation of emergency plans to manage potential risks if and when they occur.

Types of Risks You May Face in Fleet Business

Every day, more businesses devote resources and devise solutions to manage the dangers that their fleets confront. The different risks in fleet business include:

- Regulatory Fines: Massive amounts of bureaucracy and red tape have been imposed on commercial fleet owners. Navigating the regulatory minefield at the national and state levels can be a headache.

- Employee Injuries: Driving is a treacherous profession. Poor roads or weather conditions can lead to injuries and even the death of employees in some cases. Employees are also exposed to danger when they drive fatigued.

- Vehicle Damage: Not buying vehicles from trusted vendors, missing out on maintenance, or driving on poor terrain can cause vehicle breakdown and eventually expose your fleet to significant risks.

- Accident Liabilities & Lawsuits: Being held accountable in accidents and lawsuits can have wide-ranging negative impacts on a fleet. This covers the possibility of harming the company’s public image, how the fleet is handled and run, and, eventually the future of your fleet.

How to Manage Fleet Risk & Safety?

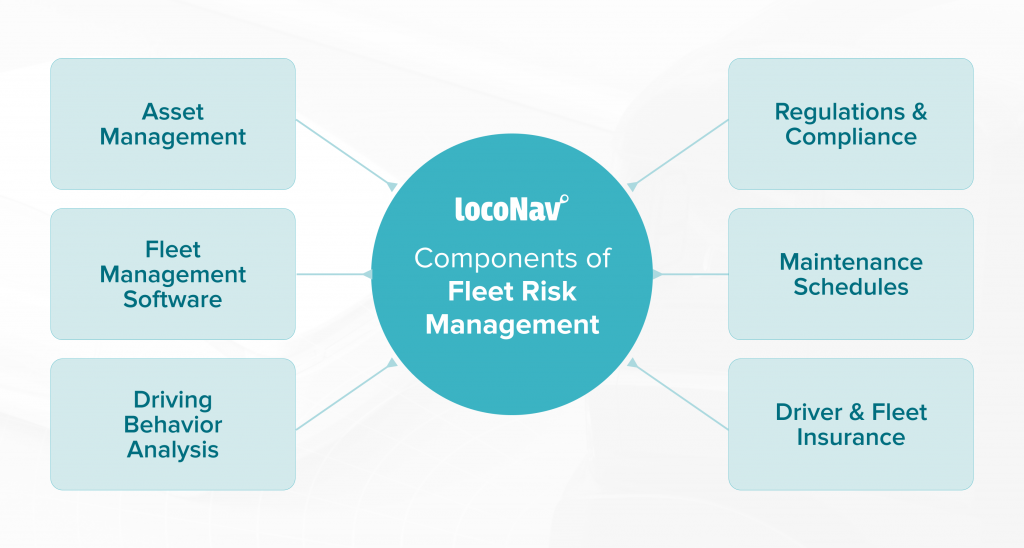

Fleet Risk Management procedures must take into account the fact that fleets are made up of various vehicles from various businesses. There is no cookie-cutter answer. Reliable fleet managers develop custom solutions that are customized to the needs of a certain organization and the hazards that it is likely to confront.

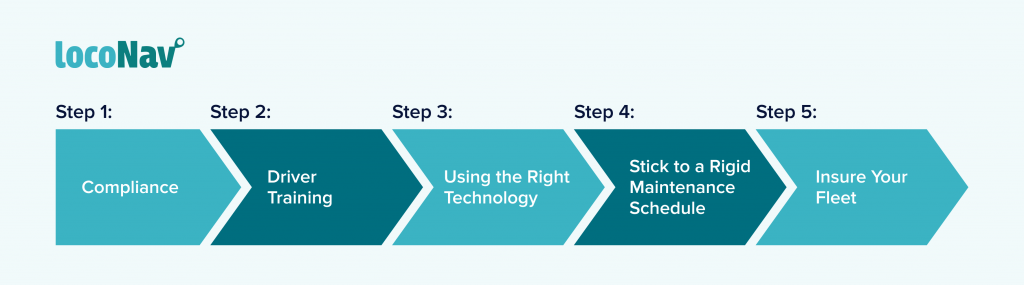

Although fleet risk management should be adjusted to your fleet’s individual needs, the following is a simple framework to get you started:

Step 1: Compliance

The first stage in fleet risk management is to ensure that your fleet adheres to all requirements. This can be simplified by hiring a dependable fleet manager with decades of work expertise in fleet management.

↓

Step 2: Driver Training

Your fleet’s safety and future are in the control of your drivers. One of the most successful tactics to have a safer fleet is to train and retrain drivers. Experienced and trained drivers are much less likely to cause fatalities or damage to your fleet.

↓

Step 3: Using the Right Technology

It is significantly easier to track driver performance utilizing onboard telematics systems and fleet management software in the digital age. Telematics can provide vital information about a driver’s habits, such as harsh braking and speeding. Drivers can view these metrics, which assist them to identify their unsafe driving tendencies.

↓

Step 4: Stick to a Rigid Maintenance Schedule

For a more secure fleet, vehicles must be subjected to maintenance regularly. All safety initiatives will be futile as long as the vehicles are in poor condition. Proper maintenance, repair, and replacement of broken parts is an essential component of safer fleets.

↓

Step 5: Insure Your Fleet

Vehicle, driver, and company-wide insurance is required for fleet safety. If your fleet is involved in an accident, insurance protects your company from any resulting losses. It may also pay for the replacement of your fleet car as well as the driver’s medical bills

Benefits of Having Fleet Risk Management Solutions

Fleet risk management provides numerous benefits to businesses that implement it, including:

- The most critical consideration is staff safety. The management of fleet hazards guarantees that your drivers and other employees operate in a safe environment. It also guarantees that your drivers do not endanger their own or others’ lives.

- You can avoid the expensive fines and legal battles that come with non-compliance.

- Prevent your company from suffering large losses as a result of the risks it confronts. Fleet risk management considerably reduces insurance expenses, incident liability costs, lawsuit fees, and fines.

- Maintain your reputation as a dependable and responsible company.

FAQs:

Can I save my business costs using risk management software?

Yes, using fleet risk management software will help prevent your company from suffering large losses as a result of the risks it confronts. Fleet risk management considerably reduces insurance expenses, incident liability costs, lawsuit fees, and fines.

How to run a fleet risk assessment?

The 5 steps of fleet risk assessment are:

- Identify potential risks.

- Identify who may be affected by those risks.

- Evaluate appropriate actions to prevent risks.

- Record your observations.

- Review risk assessment.

How to manage compliance in fleet risk management?

To address compliance in fleet risk management, make sure you first identify the appropriate compliance requirements for a fleet your size and industry. Then make sure you obtain and digitize all paperwork so you can access it easily at any time. In case of paperwork that is bound to expire, set reminders to renew them.

What challenges are resolved in fleet risk management?

Fleet risk management addresses:

- Non-compliance related fines

- Accident cost liabilities

- Vehicle breakdown costs

- Reputation management